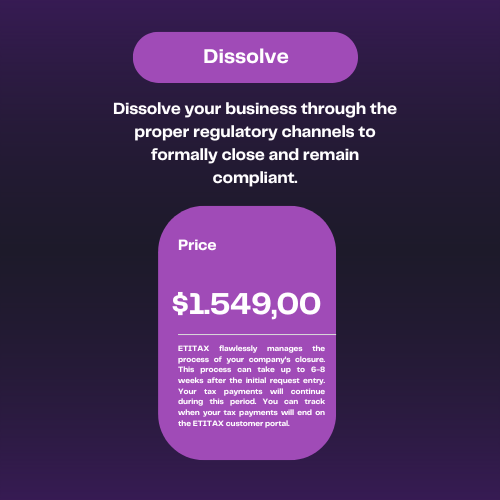

Dissolve Your Business Seamlessly and Stay Compliant

Closing a business is as important as starting one, and doing so through the proper regulatory channels is essential to ensure compliance with Turkish laws. Whether your business has achieved its purpose or circumstances have changed, ETITAX offers a hassle-free solution to help you formally dissolve your company. Our experienced team ensures every step of the process is handled efficiently, allowing you to close your business while remaining compliant with all legal obligations.

What Does It Mean to Dissolve a Business?

To dissolve a business means to formally close it through the appropriate legal processes, ensuring that it ceases operations in a manner compliant with Turkish regulations. This involves notifying the Trade Registry Office, settling all outstanding liabilities, and fulfilling reporting obligations. Proper dissolution protects business owners from future legal or financial complications, including fines or penalties for non-compliance.

Why is Proper Dissolution Important?

Formal dissolution is crucial to prevent your business from incurring additional taxes, penalties, or fees after it has ceased operations. In Türkiye, failing to dissolve a business correctly can leave it liable for ongoing tax obligations and create legal complications. Proper dissolution ensures that your company is legally removed from the registry, freeing you from future obligations and liabilities.

How ETITAX Simplifies the Dissolution Process

ETITAX specializes in managing the complexities of the dissolution process, ensuring compliance with all regulatory requirements. From preparing the necessary documents to submitting them to the relevant authorities, our team handles every detail. We coordinate with the Trade Registry Office and ensure that your tax liabilities are settled, streamlining the process so you can close your business without stress.

Key Benefits of Using ETITAX for Dissolution

Proper dissolution provides several benefits, including protecting you from legal liabilities, reducing unnecessary expenses, and allowing you to focus on future ventures. With ETITAX, you gain the confidence that every step of the process is managed professionally, ensuring compliance with Turkish laws. Our team also provides support in understanding your tax obligations during the dissolution period, ensuring a smooth transition.

Who Needs to Dissolve a Business?

Business owners who have decided to cease operations, whether due to financial, strategic, or personal reasons, need to formally dissolve their company. This process is essential for startups, small businesses, and larger enterprises alike. Whether your company is dormant or actively closing, proper dissolution ensures that you meet all legal requirements and avoid future complications.

Why Choose ETITAX for Your Dissolution Needs?

ETITAX offers an end-to-end solution for business dissolution, managing every step of the process on your behalf. Our team of experts ensures that all necessary filings are completed accurately and on time. With our assistance, you can avoid common pitfalls, such as incomplete paperwork or missed deadlines, that can lead to fines or delays. We provide clear communication and professional support to ensure your business is closed smoothly and legally.

Frequently Asked Questions

- What does dissolving a business involve?

- Dissolving a business involves formally closing it through the Trade Registry Office, settling liabilities, and fulfilling reporting obligations to ensure compliance with Turkish regulations.

- Why is proper dissolution necessary?

- Proper dissolution prevents ongoing tax liabilities, legal penalties, and additional fees for businesses that have ceased operations.

- How long does the dissolution process take?

- The process typically takes 6-8 weeks after the initial request is submitted, depending on the complexity of the case and regulatory approvals.

- Can ETITAX manage the entire dissolution process?

- Yes, ETITAX handles all aspects of the dissolution process, including document preparation, tax settlements, and regulatory filings.

- Are Chamber of Commerce expenses included in ETITAX’s fees?

- No, Chamber of Commerce expenses are not included in the service fee and must be paid separately.

- Do I need to settle all taxes before dissolution?

- Yes, all outstanding tax liabilities must be cleared before the dissolution process can be finalized.

- Is dissolution mandatory for inactive companies?

- Yes, even inactive companies must be formally dissolved to avoid ongoing tax obligations and legal issues.

- Can foreign-owned businesses use ETITAX for dissolution?

- Yes, ETITAX specializes in assisting both local and foreign-owned businesses with the dissolution process in Türkiye.

- What happens if I don’t dissolve my business properly?

- Failure to dissolve a business properly can result in ongoing tax liabilities, penalties, and potential legal complications.

- How do I start the dissolution process with ETITAX?

- Simply contact ETITAX, and our team will guide you through the process step by step, ensuring compliance and efficiency.

Reviews

There are no reviews yet.