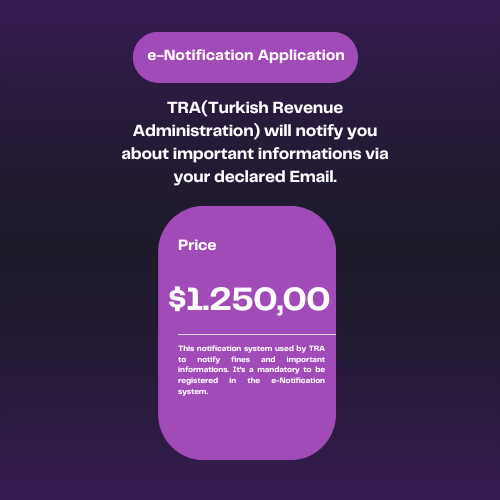

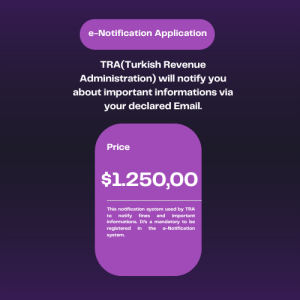

e-Notification Application: Stay Compliant and Informed

The e-Notification Application is an essential service provided by the Turkish Revenue Administration (TRA) to ensure that businesses and individuals receive critical notifications directly via their registered email. This system is mandatory for all taxpayers in Türkiye, as it serves as the official channel for receiving notifications about fines, tax updates, and other important regulatory information. ETITAX simplifies the process of registering for the e-Notification system, ensuring your business remains compliant and informed.

What is the e-Notification Application?

The e-Notification Application is a digital system implemented by the Turkish Revenue Administration to streamline communication with taxpayers. It enables businesses to receive official notifications, including tax fines and compliance updates, electronically. By registering for this system, you eliminate the risk of missing important deadlines or regulatory changes, as all communication is sent directly to your declared email address.

Why is the e-Notification Application Mandatory?

Registration for the e-Notification Application is a legal requirement for all taxpayers in Türkiye. This ensures that the TRA can communicate important information efficiently and securely. Failure to register can result in fines and non-compliance penalties. Moreover, notifications sent via the e-Notification system are considered legally valid, making it imperative for businesses to enroll promptly.

How ETITAX Simplifies the e-Notification Application Process

ETITAX provides a seamless solution for registering your business with the e-Notification Application. Our team manages the entire process, from gathering the required information to submitting your application to the TRA. We ensure that your registration is completed accurately and promptly, allowing you to focus on your business operations without the risk of missing critical communications.

Key Benefits of the e-Notification Application

The e-Notification Application offers several advantages for businesses. It ensures that you receive all official notifications from the TRA in a timely manner, helping you stay compliant and avoid penalties. The system also streamlines communication by delivering important updates directly to your email, reducing the need for traditional mail or in-person notifications. Additionally, the e-Notification system enhances record-keeping by providing a centralized, digital repository of all communications with the TRA.

Who Needs to Register for the e-Notification System?

All taxpayers in Türkiye, including businesses, entrepreneurs, and individuals, are required to register for the e-Notification Application. This system is particularly important for businesses that need to stay informed about tax deadlines, compliance requirements, and regulatory updates. Whether you’re a startup or an established company, registering for the e-Notification system is a critical step in ensuring smooth operations and legal compliance.

Why Choose ETITAX for e-Notification Application?

Choosing ETITAX for your e-Notification Application ensures a hassle-free and accurate registration process. Our experienced team understands the intricacies of the system and ensures that your business is registered correctly. By partnering with ETITAX, you can rest assured that your business will receive all official notifications from the TRA, keeping you informed and compliant at all times.

Frequently Asked Questions

- What is the purpose of the e-Notification system?

- The e-Notification system is designed to deliver official notifications, including fines and regulatory updates, directly to taxpayers via email.

- Is the e-Notification Application mandatory?

- Yes, all taxpayers in Türkiye are required to register for the e-Notification system.

- How long does it take to complete the registration?

- With ETITAX, the registration process is completed quickly, typically within a few business days.

- Can ETITAX handle the entire registration process?

- Yes, ETITAX manages the entire process, ensuring accurate and timely registration with the TRA.

- What happens if I don’t register for the e-Notification system?

- Failure to register can result in fines and penalties for non-compliance with Turkish tax regulations.

- How secure is the e-Notification system?

- The system is highly secure, using advanced encryption to ensure the confidentiality of all communications.

- Do I need to declare a specific email address for registration?

- Yes, you must provide a valid email address that will serve as the official point of contact for notifications.

- Can I change my registered email address later?

- Yes, you can update your email address in the system, and ETITAX can assist with the process if needed.

- Are notifications sent through the system legally binding?

- Yes, all notifications sent via the e-Notification system are considered legally valid and binding.

- How do I get started with the e-Notification Application process?

- Contact ETITAX, and our team will guide you through the process step by step, ensuring a smooth registration experience.

Reviews

There are no reviews yet.