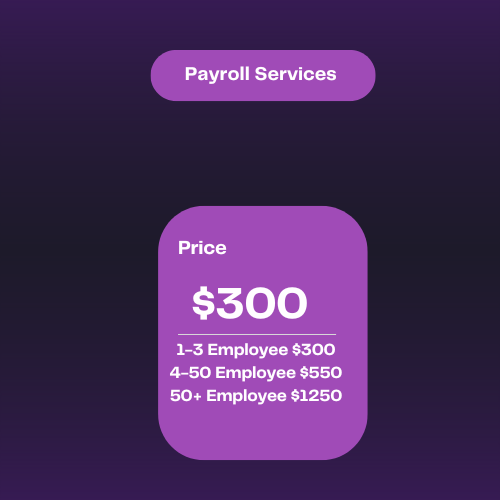

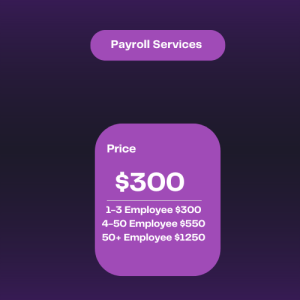

Payroll Services

Comprehensive payroll management and statutory HR compliance in Türkiye.

Managing employees in Türkiye involves strict recurring obligations and time-sensitive filings. ETITAX Payroll Services helps you stay compliant while keeping payroll, SGK processes, and payroll-related taxes accurate and under control—every month.

When Payroll Services Becomes Mandatory

Once your company starts employing personel, payroll and employment-related filings become a continuous compliance requirement. Therefore:

- Payroll Services is mandatory starting from the month your first employee is hired.

- If Payroll Services is not purchased separately, it will be automatically activated and the monthly Payroll Services fee will be reflected in your monthly charges starting from the month you employ staff.

This policy is designed to prevent missed filings and late-notification penalties.

What’s Included

1. Monthly Payroll Preparation (Bordro)

- Monthly gross-to-net salary calculations

- Digital payslips and payroll summaries

- Support for common payroll items (bonuses, overtime, unpaid leave, deductions, allowances, etc.)

2. SGK Compliance & Reporting (Social Security)

- Employee registration workflow and SGK-related submissions

- Monthly SGK declarations and ongoing compliance management

- Clear monthly status updates and recordkeeping support

3. Payroll Withholding Taxes (Personel Stopaj)

- Calculation and tracking of employee income tax withholding (stopaj)

- Support for payroll-related stamp duty items where applicable

- Ensuring payroll tax components are correctly reflected in statutory filings

4. Workforce Entry/Exit Procedures

- Handling the required documentation and notifications for:

- New hires: employee onboarding and registrations

- Terminations: exit notifications and closure procedures

Monthly Withholding Return Requirement (Important)

From the month you start employing personnel, the Withholding Return (Muhtasar / Withholding Return) must be submitted monthly, starting from the same month you employ staff. ETITAX manages this process to ensure full compliance.

Operational Notice: Hiring & Termination Updates

To ensure timely filings, please notify ETITAX via WeChat / WhatsApp / email:

- New hires: at least 2 days before the employee’s start date

- Terminations: no later than 5 days after the employee’s exit date

How the Monthly Process Works

- You share monthly payroll inputs (new hires/terminations, salary changes, leave/absence details, overtime/bonus updates).

- ETITAX prepares payroll and digital payslips (bordro).

- ETITAX completes SGK submissions and payroll withholding workflows.

- You receive clear monthly summaries of filings and amounts due.

Who This Service Is For

- Companies hiring their first employee in Türkiye

- Businesses scaling headcount and needing consistent monthly payroll compliance

- Foreign-owned entities that want payroll managed correctly end-to-end

Frequently Asked Questions

Is Payroll Services required if I have only one employee?

Yes. Employment triggers payroll, SGK, and withholding obligations regardless of headcount.

Is Payroll Services billed monthly?

Yes. Payroll Services is a monthly service and the fee is paid monthly.

What happens if I hire employees without purchasing Payroll Services?

Payroll compliance is still required. In that case, Payroll Services will be treated as mandatory and the monthly payroll service fee will be reflected in your monthly charges starting from the month employees are hired.

When does monthly filing start?

Monthly Withholding Return obligations begin from the month you employ your first employee and continue every month while you have employees.

Reviews

There are no reviews yet.