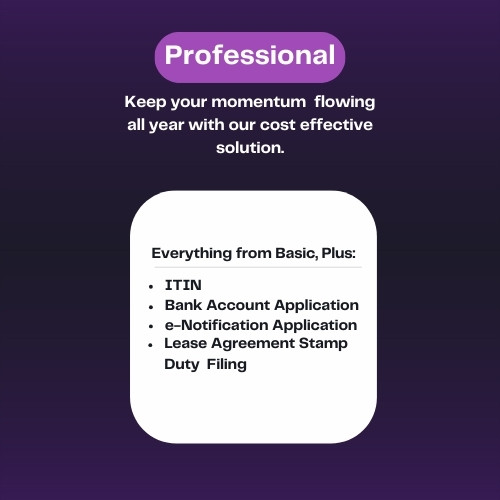

Professional Plan: Keep your momentum flowing all year with our cost-effective solution.

The Professional Plan is crafted to support businesses aiming for consistent growth and operational efficiency in Turkey. Whether you’re a small to medium enterprise or scaling your existing business, this plan provides robust tools and expert guidance to meet your needs.

What’s Included in the Professional Plan?

The Professional Plan comes with a range of services that make starting and running your business hassle-free:

- ITIN: Obtain an ITIN fort a founder. The Individual Taxpayer Identification Number of the company partner is declared in important cases such as company formation, bank account opening and tax declarations.

- E-Notification Application: Register for the e Notification application on time and avoid a penalty.

- Bank Account Application: You have established your business, now it’s time to open a bank account and start trading.

- Lease Agreement Stamp Duty Filing: We are responsible for the Lease Agreement Stamp Duty Filing, you focus on your business.

Why Choose the Professional Plan?

Starting a business is just the beginning. Take it to the next level with the Professional Plan. Designed for ambitious entrepreneurs, this plan offers advanced tools, personalized support, and strategic insights to drive growth. From optimizing operations to managing complex financial processes, our Professional Plan equips you with everything needed to scale your business confidently and efficiently.

Key Benefits of the Professional Plan

1. Smooth Operations: Access a complete range of services to manage your business effectively.

2. Simplified Banking: Get professional help to easily set up and manage your company’s bank account.

3. Compliance Made Easy: Stay on top of legal and tax requirements without stress.

4. Financial Clarity: Maintain accurate financial records with CPA-backed bookkeeping services.

5. Focus on Growth: Save time and energy while we handle the administrative details.

Who Is This Plan For?

The Professional Plan is best suited for entrepreneurs SMEs, and businesses in the growth phase that require expert support in managing compliance and operational tasks while setting a strong foundation for future expansion in Turkey.

Frequently Asked Questions

- What is ITIN registration, and why is it important?

- ITIN is required for company formation and enables businesses to handle tax obligations and financial transactions in Turkey. Trade Registry Office and Banks will demand when necessary.

- Can I switch to the Enterprise Plan if my needs grow?

- Absolutely. Our services are designed to scale with your business, and upgrading is seamless.

- Can I use the virtual office address for a bank account?

- Yes, the virtual office address provided in our plans is valid for official use, including bank account applications.

- Do you provide ongoing bookkeeping support?

- Yes, our Yearly Bookkeeping service includes continuous CPA backed support to keep your financial records accurate and up to date.

- What does e-notification application support include?

- It ensures you’re registered in Turkish Revenue Administration’s official notification system to receive important government updates and requirements.

- How long does it take to form a company under this plan?

- Company formation typically takes 5-10 business days, if every document is ready.

- What is the lease agreement stamp duty service?

- We handle the preparation and filing of your lease agreement stamp duty to comply with Turkish stamp duty rules, ensuring everything is legally sound.

- Are there any hidden fees in the Professional Plan?

- No, the Professional Plan includes all services listed. Any additional services or fees will be discussed upfront. Please check our Step by step Company Formation page.

Reviews

There are no reviews yet.